Table of Contents

Volkswagen automotive group – Global performance review

Executive Summary

In 2024, Volkswagen Group remained a global automotive powerhouse, navigating a dynamic market marked by rising competition, economic pressures, and accelerated industry transformation. While the Group maintained its position as the world’s second-largest vehicle manufacturer by unit sales, it also reinforced its leadership in global revenue, outperforming all major peers. Its diversified brand architecture, geographic breadth, and strong foundation in both combustion and electric mobility enabled it to adapt to regional shifts and sustain overall momentum.

Key Takeaways from the Year:

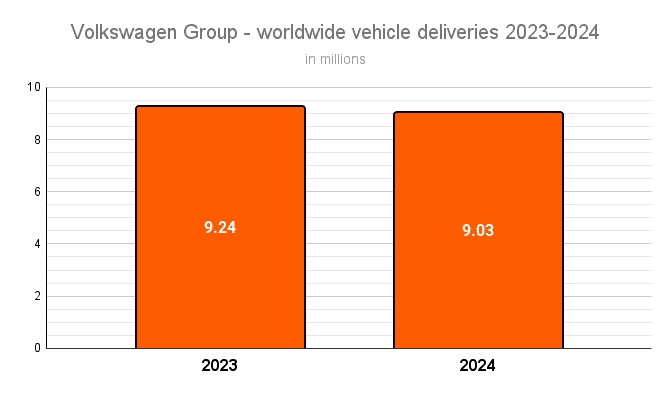

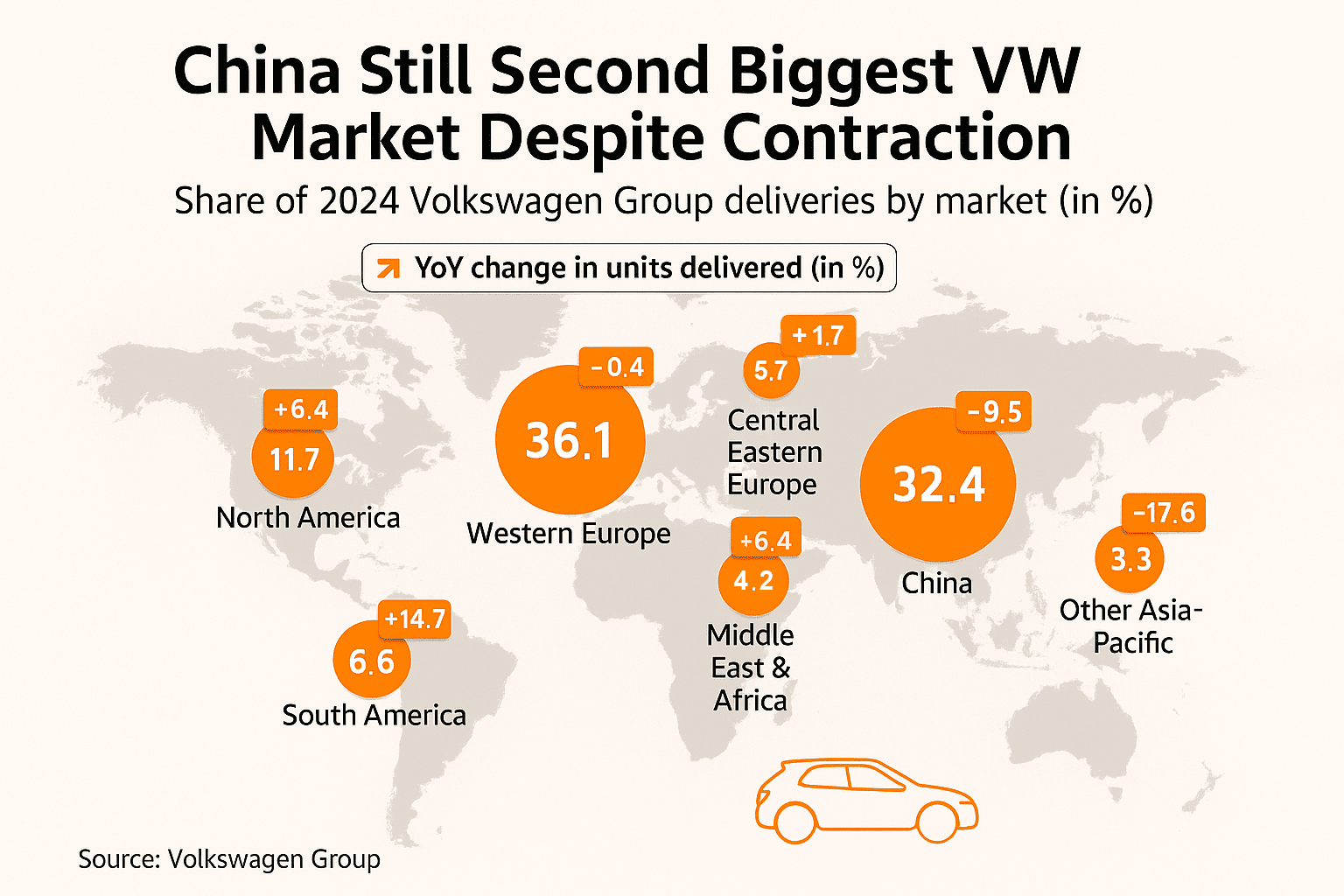

- Global Deliveries: Volkswagen delivered 9.03 million vehicles in 2024 (–2.3% YoY), with declines in China offset by growth in South America (+14.7%) and North America (+6.4%).

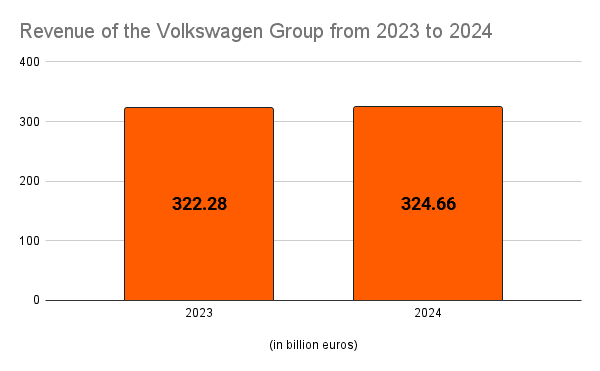

- Revenue Leadership: The Group reported €324.7 billion in revenue, up slightly from the prior year, confirming its position as the highest-grossing automaker worldwide.

- Electrification Push: BEV deliveries dropped 3.4% to 744,840 units, while PHEVs expanded slightly. Volkswagen held a 5.7% global plug-in EV market share, ranking fourth behind BYD, Tesla, and Geely.

- Regional Strength: Western Europe remained the Group’s largest market (36.1% of deliveries), with sustained leadership in EU registrations. South America posted the fastest growth, and North America continued its rebound.

- Strategic Transformation: Key focus areas included platform consolidation (SSP, PPE), battery development (PowerCo), cost optimisation (€1.5 billion personnel savings), and software-defined vehicle initiatives, including partnerships with XPeng and Rivian.

Volkswagen’s 2024 results reflect both resilience in a rapidly evolving market and deep investment in long-term transformation. The Group enters 2025 with a sharpened focus on electrification, digitalisation, and operational efficiency across all regions and brands.

Brand Value and Market Position

Volkswagen Group in the Global Hierarchy

In 2024, Volkswagen Group maintained its role as one of the most prominent players in the global automotive landscape. Despite mounting competitive pressure and shifting market dynamics, the Group demonstrated consistency in both brand equity and sales performance. While some competitors experienced declines or limited growth, Volkswagen maintained a stable position, supported by its diverse product portfolio and consistent performance.

Brand Value Rankings

According to the 2024 Kantar BrandZ rankings, two Volkswagen Group brands ranked among the world’s ten most valuable in the automotive sector. Porsche led the Group’s entries with a brand value of $16.66 billion, followed by Audi at $7.03 billion, ranking tenth globally. Though Tesla ($71.9B) and Toyota ($30.2B) dominated the top of the list, Volkswagen’s ability to position multiple premium brands within the top tier reinforces the strength and global appeal of its brand ecosystem.

(Source: https://www.statista.com/statistics/267830/brand-values-of-the-top-10-most-valuable-car-brands/ )

Market Share and Competitor Dynamics

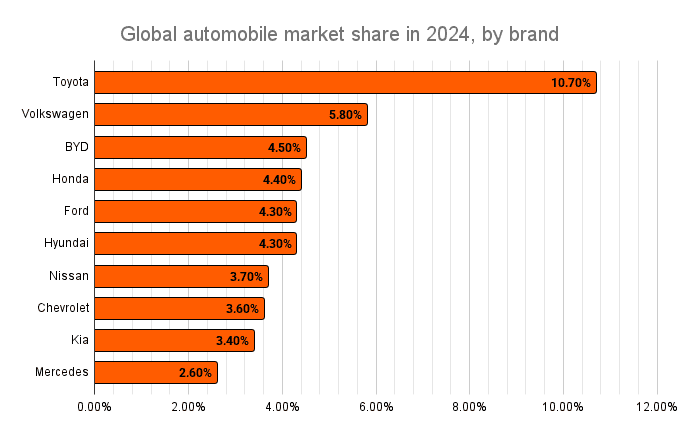

(Source: https://www.statista.com/statistics/316786/global-market-share-of-the-leading-automakers/ )

Volkswagen accounted for 5.8% of the global car market in 2024, placing it behind Toyota (10.7%) but ahead of BYD (4.5%) and Honda (4.4%). The Group maintained its global second-place ranking by unit sales, delivering over 9 million vehicles worldwide.

2024 in Perspective

In 2024, Volkswagen Group demonstrated both brand strength and market resilience. With high brand valuations across multiple subsidiaries, it preserved its status as one of the automotive world’s central players — setting the tone for an ambitious 2025.

Production & Global Deliveries

Steady Output with Regional Divergence

In 2024, Volkswagen Group faced a mixed operating environment — marked by intensified competition, regional demand shifts, and economic pressures in China. Despite these challenges, the Group preserved high global output and maintained consistent delivery volumes in key international markets. These figures reflect the strategic weight of Volkswagen’s diversified global presence.

Global Production Overview

Source: https://www.statista.com/statistics/272050/worldwide-vehicle-production-of-volkswagen-since-2006/

Volkswagen Group produced approximately 8.95 million vehicles in 2024, a 3.8% decline from the 9.31 million units produced in 2023. This reversal came after a year of production growth, reflecting reduced output in China and adjustments in European capacity. According to the annual report, production excluding Chinese joint ventures totaled 6.21 million units, remaining largely flat compared to the previous year. Vehicle sales declined at a similar pace (3.5%) from 9.36 million units in 2023 to 9.04 million in 2024. The decrease was fueled almost entirely by sales from Chinese joint ventures, as other sales stagnated at 6.3 million units.

The Group’s production volumes remain relatively strong—still above the 2020–2022 average—but trail their pre-pandemic highs of over 10 million units.

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 2)

Vehicle Deliveries: Regional Balancing

Source: https://www.statista.com/statistics/272049/worldwide-vehicle-sales-of-volkswagen-since-2006/

Volkswagen delivered 9.03 million vehicles globally in 2024, compared to 9.24 million in 2023, representing a 2.3% year-over-year decrease. This trend stems primarily from reduced demand in China, which outweighed gains in other regions. Notably:

- China deliveries dropped by 9.5%,

- North America saw a 6.4% increase,

- South America reported 14.7% growth,

- Europe remained stable (Western Europe -0.4% and Central and Eastern Europe +1.7%).

Despite the decline, Volkswagen remained the world’s second-largest vehicle manufacturer, behind Toyota.

Performance by Brand Groups

From a brand perspective, the Core Brand Group—including Volkswagen Passenger Cars, Škoda, SEAT/CUPRA, and Volkswagen Commercial Vehicles—reported a slight volume increase from 4.83 million in 2023 to 4.96 million in 2024, up 2.8%.

- Volkswagen Passenger Cars led with 3.11 million units, up from 3.02 million.

- Škoda and SEAT/CUPRA also saw growth.

- However, the Progressive Brand Group (Audi, Bentley, Lamborghini, Ducati) experienced a decline from 1.28 million to 1.12 million units, reflecting cautious demand in luxury segments and model cycle transitions.

- Porsche sales also fell slightly from 334,000 to 313,000 units.

|

Thousand vehicles/€ million |

VEHICLE SALES |

SALES REVENUE |

OPERATING RESULT |

|||

|---|---|---|---|---|---|---|

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023¹ | |

| Core brand group | 4,96 | 4,83 | 140,00 | 137,77 | 6,96 | 7,24 |

| Progressive brand group | 1,12 | 1,28 | 64,53 | 69,87 | 3,90 | 6,28 |

| Sport Luxury brand group² | 313,00 | 334,00 | 36,44 | 37,35 | 5,29 | 6,94 |

| CARIAD | – | – | 1,33 | 1,08 | -2,43 | -2,39 |

| Battery | – | – | 8,00 | 31,00 | -1,05 | -417,00 |

| TRATON Commercial Vehicles | 335,00 | 339,00 | 46,18 | 45,73 | 4,20 | 3,72 |

| Equity-accounted companies in China³ | 2,74 | 3,07 | – | – | – | – |

| MAN Energy Solutions | – | – | 4,33 | 4,04 | 337,00 | 369,00 |

| Volkswagen Group Mobility | – | – | 54,81 | 50,77 | 3,00 | 3,25 |

| Other⁴ | -435,00 | -484,00 | -22,98 | -24,35 | -1,15 | -2,46 |

| Volkswagen Group | 9,04 | 9,36 | 324,66 | 322,28 | 19,06 | 22,53 |

¹ Prior-year figures adjusted.

² Including Porsche Financial Services: sales revenue €40,083 (40,530) million, operating result €5,640 (7,284) million.

³ The sales revenue and operating result of the equity-accounted companies in China are not included in the consolidated figures; the share of the operating result generated by these companies amounted to €1,742 (2,621) million.

⁴ In the operating result, mainly intragroup items recognized in profit or loss, in particular from the elimination of intercompany profits; the figure includes depreciation and amortization of identifiable assets as part of purchase price allocation, as well as companies not allocated to the brands

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 22)

|

Thousand vehicles/€ million |

VEHICLE SALES |

SALES REVENUE |

OPERATING RESULT |

|||

|---|---|---|---|---|---|---|

| 2024 | 2023 | 2024 | 2023 | 2024 | 2023¹ | |

| Volkswagen Passenger Cars | 3,109 | 3,016 | 88,262 | 86,382 | 2,587 | 3,514 |

| Škoda | 1,09 | 1,056 | 27,787 | 26,536 | 2,305 | 1,773 |

| SEAT/CUPRA | 637 | 602 | 14,53 | 14,333 | 633 | 625 |

| Volkswagen Commercial Vehicles | 404 | 423 | 15,124 | 15,325 | 743 | 869 |

| Tech. Components | – | – | 20,645 | 21,282 | 703 | 583 |

| Consolidation | -281 | -270 | -26,345 | -26,088 | -11 | -121 |

| Core brand group | 4,96 | 4,826 | 140,004 | 137,77 | 6,961 | 7,242 |

¹ Prior-year figures adjusted

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 22)

A Year of Operational Balance

Volkswagen Group’s production and delivery metrics in 2024 demonstrate operational stability amid shifting global demand. Although total volumes decreased slightly, consistent output outside China and strength in key brands like Volkswagen and Škoda softened the impact. As the Group enters 2025, its capacity to adapt across regions and market tiers will be critical in regaining growth momentum.

Financial Overview

Volkswagen Group’s financial performance in 2024 demonstrated a combination of revenue stability, disciplined cost control, and forward-looking investment. Despite a challenging global environment, the Group continued to allocate resources toward electrification, digitalisation, and strategic regional expansion—all while reinforcing its financial robustness through cost and workforce restructuring measures.

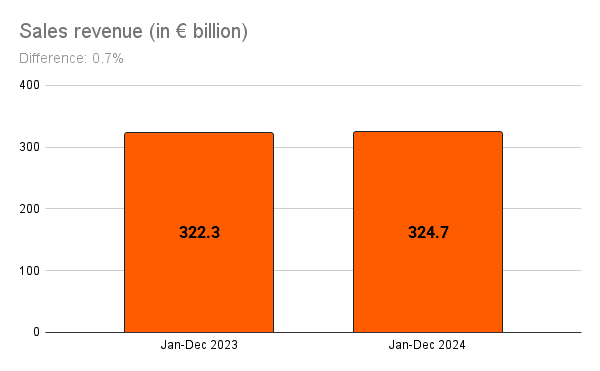

Total Revenue Growth

Volkswagen Group generated €324.66 billion in consolidated revenue in 2024, up slightly from €322.3 billion in 2023, reflecting continued top-line strength. This positions Volkswagen among the global leaders in terms of automotive sector revenue and supports its planned shareholder return: a proposed dividend of €6.36 per preferred share, equivalent to 30% of net profit.

Source: https://www.statista.com/statistics/264349/sales-revenue-of-volkswagen-ag-since-2006/

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 2)

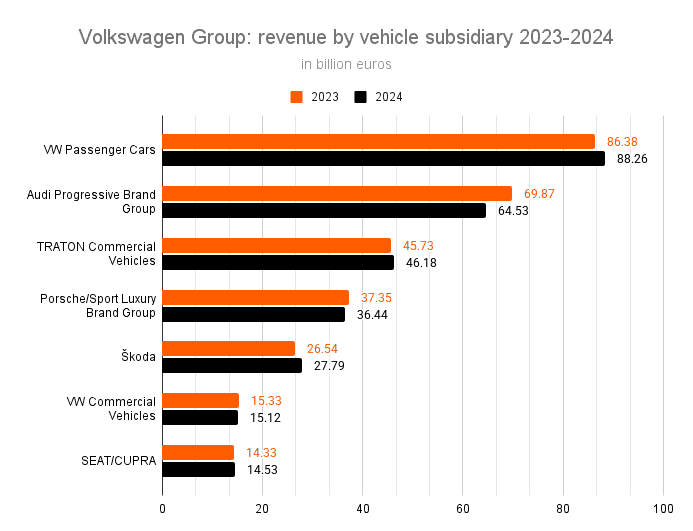

Segment Revenue: Contributions by Brand

The Group’s revenue breakdown by brand and business area highlights its diverse earning streams:

- Volkswagen Passenger Cars remained the primary revenue generator.

- Porsche delivered €36.4 billion in revenue, reinforcing its role as a high-margin brand.

- Audi, part of the Progressive Brand Group, continued to perform strongly in the premium segment, though the operating profit dropped to €3.9 billion from €6.3 billion in 2023.

- TRATON Commercial Vehicles, encompassing MAN and Scania, also contributed significantly amid global logistics demand.

This mix of mass-market and premium offerings strengthens Volkswagen’s resilience across economic cycles.

Source: https://www.statista.com/statistics/275868/sales-figures-for-volkswagen-by-brand/

Source: https://www.statista.com/statistics/275870/revenue-of-volkswagen-group-by-brand/

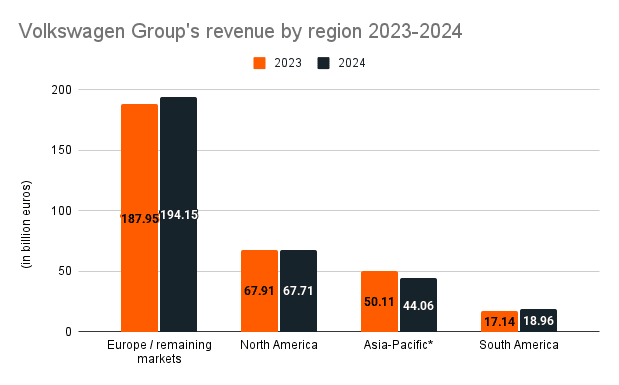

Regional Revenue and Strategic Initiatives

Regionally, Europe remained the strongest revenue contributor, followed by China and North America. To ensure long-term competitiveness, the Group launched cost-reduction initiatives including the “Zukunft Volkswagen” agreement, which aims to:

- Cut annual personnel costs by €1.5 billion,

- Achieve €4 billion+ in medium-term savings,

- Reduce the workforce by over 35,000 employees by 2030.

Strategic Investments and Software Partnerships

Volkswagen sharpened its investment focus on electrification, digital transformation, and localisation:

- Key capital expenditure areas included the Scalable Systems Platform (SSP), sustainability, and EV capacity expansion in North America and China.

- The Group expects its automotive investment ratio to remain between 12% and 13% in 2025, funded through internal cash flows.

Additionally, Volkswagen restructured its software arm CARIAD, assigning it to focus on cross-platform technologies. Meanwhile, it entered new partnerships with XPeng in China and Rivian in the U.S., aimed at accelerating software innovation and creating zonal electronic architectures for next-gen vehicles.

Geographic Markets and Sales Performance

Regional Shifts in a Fragmented Market

Volkswagen Group's geographic footprint remained expansive in 2024, with the company operating in all major global regions. However, growth dynamics varied significantly across markets. While Western Europe continued to be the Group’s largest regional base, emerging markets like South America delivered the most notable gains. In contrast, China — long Volkswagen’s most critical single market — experienced a sharp contraction, impacting both unit sales and regional revenue.

Key Market Shares and Deliveries

According to the Group's 2024 delivery breakdown:

- Western Europe led with 36.1% of global deliveries, with volume remaining almost unchanged year-over-year at –0.4%.

- China, despite a -9.5% decline, remained Volkswagen’s second-largest market at 32.4% of total deliveries.

- North America accounted for 11.7%, growing +6.4% from the previous year.

- South America surged by +14.7%, now representing 6.6% of deliveries.

- Smaller growth was seen in Central and Eastern Europe (+1.7%) and Middle East & Africa (+6.4%), while the Other Asia-Pacific region fell sharply at -17.6%.

These figures reflect a strategic rebalancing, with gains in the Americas offsetting delivery losses in Asia.

Source: https://www.statista.com/chart/33756/share-of-volkswagen-group-deliveries-by-market/

Regional Revenue and Performance Breakdown

Volkswagen Group’s regional financial and delivery performance in 2024 showed both continuity and recalibration when compared to 2023.

- Europe remained the Group’s economic core. Revenue from the region increased from €187.9 billion in 2023 to €194.1 billion in 2024, driven primarily by Financial Services and steady vehicle sales at 4.2 million units. This confirmed the Group’s dominant presence in Western and Central Europe, despite marginal volume fluctuation.

- China and the wider Asia-Pacific region experienced pronounced declines. In China, revenue fell from €44.4 billion to €40.6 billion, a -8.6% drop, while unit sales dropped nearly 10%. In the broader Asia-Pacific, revenue dropped more sharply—from €50.1 billion to €44.1 billion, aligning with the -12.6% decline in deliveries noted in the annual report. This contraction reflects competitive pressure from local EV brands and economic headwinds in the region.

- North America remained stable in terms of sales volume at 1.1 million units, while revenue slightly dipped from €67.9 billion to €67.7 billion, suggesting a relatively constant pricing and volume mix.

- South America emerged as the fastest-growing region for the Group. Revenue jumped from €17.1 billion in 2023 to €19.0 billion in 2024, and unit sales surged from 513,000 to 606,000, highlighting rising demand and successful regional positioning.

These shifts underscore how Volkswagen has become less reliant on China for growth, while Europe, North America, and South America now collectively form a more balanced revenue base.

Source: https://www.statista.com/statistics/260805/revenue-of-volkswagen/

Realigning for Global Balance

Volkswagen’s 2024 regional sales and revenue performance highlight a pivotal transition in its global market strategy. While traditional powerhouses like Western Europe and China still form the foundation of operations, growth is increasingly driven by South America and North America. The company’s ability to stabilise revenue despite volatility in China reflects its balanced international structure. As market conditions evolve, regional diversification will be central to Volkswagen’s sustained global relevance.

Electrification & Sustainability

Advancing Toward an Electric Future

Volkswagen Group continued to expand its electrification strategy in 2024, strengthening its role in the evolving global EV market. The company emphasised technological convergence, regional EV growth, and the scaling of in-house battery production. While battery-electric vehicle (BEV) volumes experienced a modest decline, the Group’s broader electrified offering—including plug-in hybrids (PHEVs)—delivered stability across key markets.

BEV Deliveries and Brand Contributions

In 2024, Volkswagen Group delivered a total of 744,800 battery-electric vehicles, representing a 3.4% year-over-year decline. Despite the drop, BEVs remained a strategic focus, with most deliveries concentrated in Europe and China.

Source: https://www.statista.com/statistics/1270499/volkswagen-group-battery-electric-vehicle-deliveries-by-brand/

- Volkswagen Passenger Cars accounted for 51.4% of total BEV deliveries.

- Other key contributors included Audi, Škoda, SEAT/CUPRA, and Porsche, which benefited from premium segment interest despite cost sensitivity.

- New model launches such as the Audi Q6 e-tron and the upcoming ID. EVERY1 marked the Group’s intent to refresh and democratise its EV lineup.

The rollout of the Premium Platform Electric (PPE) and the development of a standardised battery cell through Volkswagen’s PowerCo subsidiary further underlined its long-term electrification infrastructure.

PHEV Growth and Portfolio Balance

In contrast to the BEV contraction, PHEV deliveries grew by 4.9%, reaching 269,600 units in 2024. Plug-in hybrids provided flexibility in markets where charging infrastructure is still developing or where regulatory conditions favour mixed propulsion systems. The growth of PHEVs helped cushion the impact of BEV softness, especially in Asia and North America.

Source: https://www.statista.com/statistics/1300179/volkswagen-phev-deliveries-worldwide/

Global Plug-in EV Market Share

Volkswagen Group held a 5.7% share of the global plug-in EV (BEV + PHEV) market in 2024, ranking fourth worldwide behind:

- BYD (24.7%)

- Tesla (10.4%)

- Geely-Volvo (8.3%)

Source: https://www.statista.com/statistics/541390/global-sales-of-plug-in-electric-vehicle-manufacturers/

Although outpaced by Chinese and American rivals, Volkswagen’s diverse brand offering and geographic reach continue to provide it with strong foundations in Europe and emerging resilience in North America.

2023 vs. 2024: Key Shifts

- BEV volumes declined by 3.4%, indicating cooling demand and possible competitive pricing pressures.

- PHEV deliveries increased by 4.9%, helping offset BEV volume losses.

- The Group maintained its #1 position in all-electric vehicles in Europe, despite increased competition.

- New partnerships (e.g., with XPeng and Rivian) were launched to accelerate the development of software-defined vehicles and next-gen EV platforms.

EV Performance in Transition

Volkswagen Group’s electrification strategy in 2024 was one of cautious adjustment and strategic realignment. While BEV growth temporarily slowed, PHEVs offered crucial balance, and long-term investments in platforms, battery production, and software innovation remained on track. As the Group prepares for a wave of new EV launches through 2030, it enters the next phase of electrification with both strategic partnerships and scalable architecture in place.

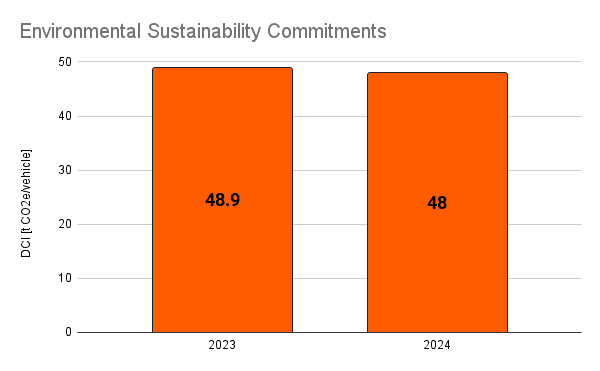

Environmental Sustainability Commitments

In parallel with its electrification goals, Volkswagen Group continued to strengthen its environmental sustainability strategy in 2024. The Group achieved a reduction in average lifecycle CO₂ emissions per vehicle to 48.0 tons of CO₂e, down 0.9 tons from the previous year, driven by improved supply chain emissions and a shift toward smaller vehicle segments. Sustainability targets also included expanding the use of circular materials, with the goal of reaching 40% circular content in vehicles by 2040 (excluding China), and enhancing the recyclability of electric vehicle components. Volkswagen is preparing to meet future EU regulations on battery and vehicle recyclate content, including sourcing 6% lithium and 16% cobalt from end-of-life batteries by 2031. Moreover, its supply chain sustainability program targets 85% of direct suppliers meeting positive S-Rating standards by 2025, rising to 95% by 2040. These initiatives highlight Volkswagen's growing commitment to embedding circularity and emissions reduction into its long-term business model.

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 280)

Human Capital

Workforce Stability During a Period of Transition

Volkswagen Group maintained a stable and sizable global workforce in 2024, despite economic headwinds and ongoing structural transformation. The Group's human capital base remains one of the largest in the automotive industry, reflecting its global reach, regional production capacity, and continued investment in innovation, digitalisation, and electrification. Labour relations, gender distribution, and regional employment patterns all underscore a strategy grounded in long-term workforce development.

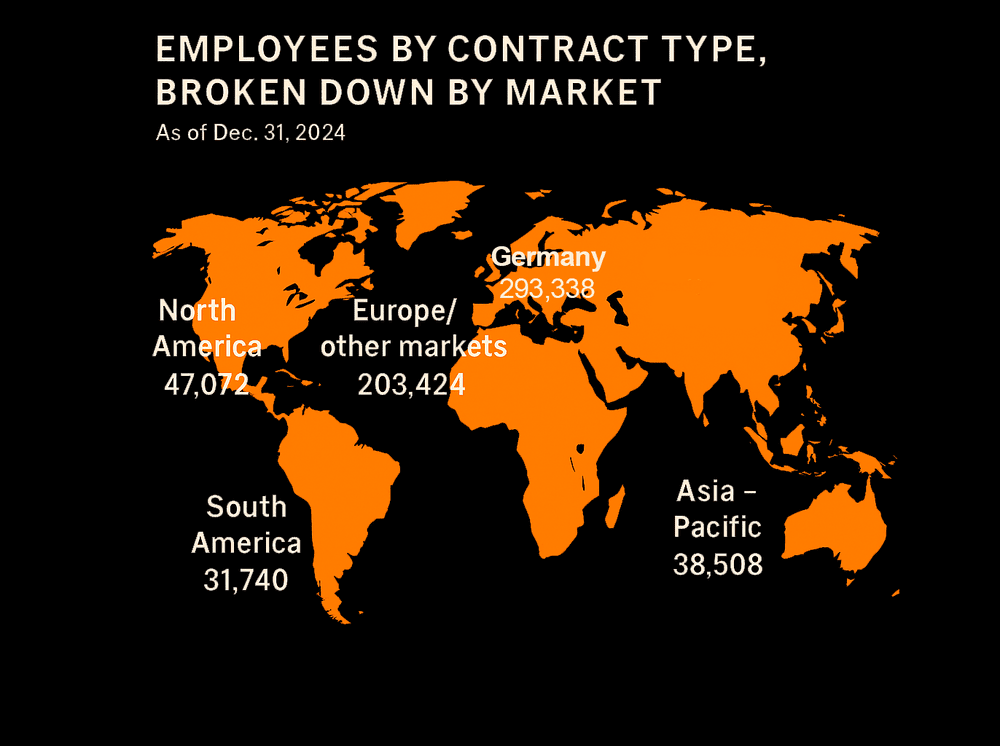

Total Workforce and Contract Types

As of December 31, 2024, Volkswagen Group employed 614,082 people globally, down from approximately 675,800 in 2023 — reflecting the effects of personnel streamlining and business model adjustments across several operations.

- Of the total workforce:

- 591,137 employees had permanent contracts.

- 22,945 employees were on temporary contracts.

- Gender representation was:

- 79.8% male (489,917 employees),

- 20.2% female (124,125 employees),

- With 7 employees identifying as “other” and 33 not disclosing gender.

The Group did not report any employees under non-guaranteed hours in 2024, suggesting a highly formalised and structured employment base.

|

Employees by contract type, broken down by gender |

|||||

|---|---|---|---|---|---|

| Male | Female | Other | Not disclosed | Total | |

| Employees | 489,917 | 124,125 | 7 | 0 | 614,082 |

| Employees with a permanent contract | 473,198 | 117,902 | 4 | 33 | 591,137 |

| Employees with a temporary employment contract | 16,719 | 6,223 | 3 | 0 | 22,945 |

| Non-guaranteed hours employees | 0 | 0 | 0 | 0 | 0 |

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 382)

Regional Distribution of Workforce

Volkswagen’s workforce was distributed across five primary regions:

- Germany: 293,338 employees (47.8% of total)

- Europe/Other Markets (excluding Germany): 203,424

- North America: 47,072

- South America: 31,740

- Asia-Pacific: 38,508

|

Regional Distribution of Workforce |

|||||

|---|---|---|---|---|---|

| Germany | Europe/Other Markets* | North America | South America | Asia-Pacific | |

| Employees | 293,338 | 203,424 | 47,072 | 31,740 | 38,508 |

| Employees with a permanent contract | 285,935 | 193,767 | 45,791 | 30,019 | 35,625 |

| Employees with a temporary employment contract | 7,403 | 9,657 | 1,281 | 1,721 | 2,883 |

* Excluding Germany

Source: https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf?h=5AteXYgL (page 383)

This distribution highlights the Group’s continued concentration in Europe, particularly Germany (where almost half of its global headcount is based). Regions like South America and Asia-Pacific represent growth hubs, supported by increasing regionalisation of production and services.

Comparison to 2023

Compared to 2023, the overall workforce decreased by nearly 61,700 employees, aligning with previously announced restructuring programs such as the “Zukunft Volkswagen” initiative, which aims to reduce fixed costs and optimise operational efficiency. The share of permanent employees remained strong, and no significant increase in temporary or external labour was observed. Regional headcount remained relatively proportional year-over-year, with reductions concentrated in areas undergoing efficiency measures.

Sustaining Global Talent Through Stability

Volkswagen Group's workforce in 2024 remained both geographically diverse and structurally resilient. Permanent contracts continue to dominate, reflecting the Group’s commitment to long-term employment. The slight contraction in headcount mirrors strategic decisions to streamline operations without undermining core capacities. With nearly 92% of EEA employees covered by collective bargaining agreements and a high level of workplace representation, the Group maintains a strong labour relations infrastructure. Human capital remains a pillar of Volkswagen’s transformation strategy —balancing economic adaptation with its responsibility to employees worldwide.

Competitive Positioning

Navigating a Reshaped Competitive Landscape

Volkswagen Group continues to rank among the world’s leading automotive manufacturers, both in terms of unit sales and total revenue. However, in 2024, the competitive environment intensified further with rapid growth from electric vehicle specialists and volume-focused Asian manufacturers. This shift reshaped brand rankings and revenue hierarchies, especially as the global market surpassed 78 million car sales for the first time since the pandemic.

Global Brand Ranking and Market Share

In terms of global market share by brand, Volkswagen ranked second worldwide in 2024 with 5.8%, behind only Toyota, which held a 10.7% share. Close competitors included BYD (4.5%), Honda (4.4%), and Ford (4.3%).

Source: https://www.statista.com/statistics/316786/global-market-share-of-the-leading-automakers/

This ranking shows that while Volkswagen retained a strong presence, its lead over emerging electric players like BYD is narrowing rapidly. Notably, BYD grew its market share primarily through surging demand in China and global EV exports.

In terms of vehicle sales, Volkswagen sold 9.03 million units, again placing it second behind Toyota’s 10.82 million units, and ahead of Hyundai Motor Group at 6.9 million units.

Source: https://www.statista.com/statistics/275520/ranking-of-car-manufacturers-based-on-global-sales/

Revenue Performance vs. Peers

Volkswagen Group led the global automotive sector by revenue in May of 2024, reaching $348.6 billion, well ahead of Toyota ($311.9B), Stellantis ($204.9B), and Ford ($177.5B). This makes Volkswagen the highest-grossing automaker globally, largely due to its diversified brand portfolio and strong European base.

Meanwhile, other competitors showed the following revenues:

- General Motors: $174.9 billion

- BMW Group: $168.3 billion

- Mercedes-Benz Group: $164.3 billion

- Honda Motor: $141.3 billion

Despite losing the delivery volume crown, Volkswagen’s ability to command high per-unit revenue — especially from brands like Porsche and Audi — bolsters its financial leadership.

Source: https://www.statista.com/statistics/269034/leading-car-companies-worldwide-based-on-revenue/

Europe: Regional Leadership Maintained

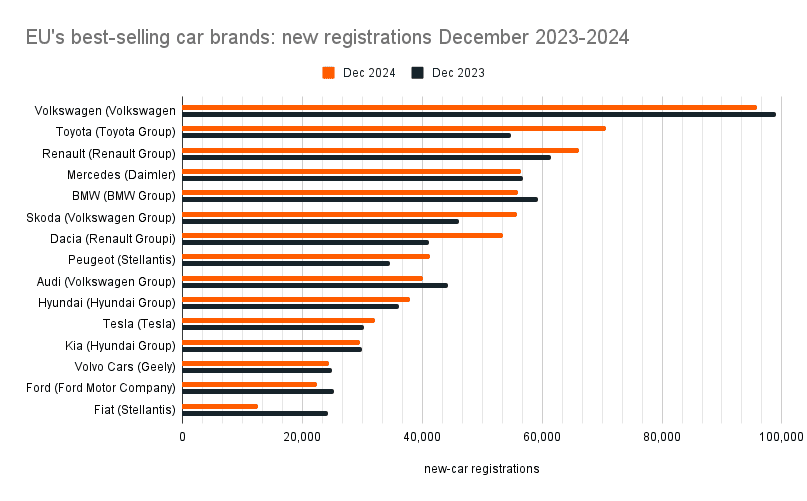

In the European Union, Volkswagen remained the best-selling car brand in December 2024, with 99,029 new registrations, ahead of Toyota, Renault, and Mercedes-Benz. This illustrates its enduring popularity in its home region and underlines the Group’s resilience amid electrification and competition from Tesla and Chinese OEMs.

Source: https://www.statista.com/statistics/264031/top-selling-car-brands-in-europe-by-number-of-new-registrations/

2023 vs. 2024: Trends and Shifts

- Volkswagen maintained its global #2 ranking by sales volume, though the gap with Toyota slightly widened.

- Revenue leadership was strengthened, with VW staying ahead of Toyota in total income.

- Competitors like BYD and Tesla continued climbing the rankings in both volume and EV share.

- VW retained dominance in Europe but faced erosion in Asian markets, notably in China, where local EV brands surged.

Summary: Strength in Scale, Pressure from Innovation

In 2024, Volkswagen Group confirmed its role as a global heavyweight, leading in revenue, holding second place in global volume, and preserving its leadership in Europe. However, intensifying competition from fast-moving EV players such as BYD, Tesla, and Geely-Volvo, as well as enduring pressure from Toyota in the volume segment, continue to challenge the Group’s dominance. The data reveals that while Volkswagen’s legacy strengths remain robust, its future competitiveness will increasingly rely on successful electrification, brand innovation, and geographic diversification.

Conclusion & Strategic Outlook

Closing the Year: Key Highlights

Volkswagen Group concluded 2024 with a balanced performance across most segments, despite an increasingly competitive and volatile global automotive landscape. Total vehicle deliveries reached 9.03 million, a 2.3% year-over-year decrease, driven by declining sales in China and cost challenges from ongoing restructuring initiatives. However, robust growth in South America (+14.7%) and stable volume in Europe provided regional resilience.

Financially, the Group reported €324.7 billion in revenue, slightly above 2023’s €322.3 billion, while the operating result declined from €22.5 billion to €19.1 billion, largely impacted by higher fixed costs and transformation investments.

In the electric vehicle segment, Volkswagen Group delivered 744,840 BEVs in 2024, a 3.4% decrease from 771,100 in 2023 —and maintained a top-five position globally for plug-in vehicles. The Group also expanded its plug-in hybrid lineup and reported stable growth in sustainability metrics, such as reducing production-related CO₂ emissions and improving circular economy practices.

Strategic Priorities: 2025 and Beyond

The Group’s strategy through 2025 focuses on several key dimensions:

- E-Mobility and Model Offensive: Volkswagen will continue its major EV rollout with over 30 new models planned across brands. Key introductions include the ID. EVERY1, Audi Q6 e-tron, and Porsche Macan EV, all built on the new PPE platform.

- Software-Defined Vehicles (SDV): Through partnerships with Rivian and XPeng, the Group is investing in forward-looking software architectures and digital in-car ecosystems. Volkswagen’s in-house software arm, CARIAD, will focus on core cross-brand technologies and zonal control systems.

- Battery and Power Innovation: The unit cell platform developed by PowerCo aims to unify the Group’s battery efforts and reduce complexity, forming the backbone of its next-gen EV strategy. Gigafactory investments and partnerships will drive cost efficiency and regional sourcing.

- Regional Strategies:

- In China, the “In China, for China” initiative will bring 30 new EV models by 2030, tailored to local market preferences.

- In North America, continued investment in local production and American-centric product portfolios positions the Group for market share expansion.

- Europe remains central, with strong ICE and BEV leadership.

- Cost Optimisation: Initiatives such as the Zukunft Volkswagen agreement are expected to reduce personnel costs by €1.5 billion annually and enhance operational efficiency through digitalisation and platform consolidation.

Driving Forward: Innovation, Responsibility, and Competitiveness

Volkswagen’s long-term vision—“The Global Automotive Tech Driver”—frames its transformation efforts as both a mobility provider and a software-driven manufacturer. Emphasis on sustainability, from carbon reduction to social responsibility programs, underscores its ambition to lead responsibly while growing profitably.

With a strong global footprint, clear strategic priorities, and a diversified brand portfolio, Volkswagen is positioned to navigate 2025’s challenges while advancing its transformation journey.

Sources:

- Volkswagen Group Dossier from Statista

- https://www.statista.com/study/15785/volkswagen-statista-dossier/

- Volkswagen Group Annual Report 2024

- https://annualreport2024.volkswagen-group.com/_assets/downloads/entire-vw-ar24.pdf