Table of Contents

Mercedes-Benz automotive group – Global performance review

Executive Summary

In 2024, Mercedes-Benz Group navigated a demanding global landscape shaped by tightening margins, intensified EV competition, and regionally uneven consumer demand. While total deliveries and revenue declined year-over-year, the company preserved its position as a global leader in the premium automotive segment. Mercedes-Benz achieved the second-highest luxury car sales worldwide and outperformed core rivals in revenue generation. Strategic investments in electrification, software-defined vehicles, and workforce reskilling underscored its long-term transformation agenda, even as short-term pressures weighed on performance. Entering 2025, the Group retains strong brand equity and a high-value market position amid the evolving mobility landscape.

Key Takeaways from the Year:

- Global Deliveries: Mercedes-Benz Group delivered 2.39 million vehicles in 2024 (−4.1% YoY), with volume declines in China and Europe partially offset by gains in the United States and smaller growth in other regions.

- Revenue and Profitability: Group revenue fell 5.0% to €145.6 billion. EBIT declined significantly to €13.6 billion, primarily due to lower volumes and transformation-related costs.

- Electrification Dynamics: BEV sales declined 23.1% to 185,059 units, while PHEVs rose 13.0%. xEVs represented 18.5% of passenger car sales. Electrified van sales dropped 13.9%.

- Regional Trends: Europe and Asia saw year-over-year volume declines, while the U.S. market posted a strong recovery (+8.9%). Sales in Latin America, the Middle East, Africa, and Oceania grew modestly.

- Strategic Focus: The Group advanced key transformation pillars—MB.OS development, modular platform rollout (MMA, MB.EA, VAN.EA), green charging infrastructure, and digital workforce training—supporting long-term competitiveness.

Mercedes-Benz enters 2025 focused on navigating short-term volatility while executing a forward-looking strategy anchored in luxury, innovation, and sustainability.

Brand Value and Market Position

In 2024, Mercedes-Benz remained one of the world’s most valuable automotive brands, though its relative position shifted amid intensifying global competition, particularly from electric vehicle (EV) leaders and high-volume manufacturers.

Brand Value: Strong Standing in the Global Top Five

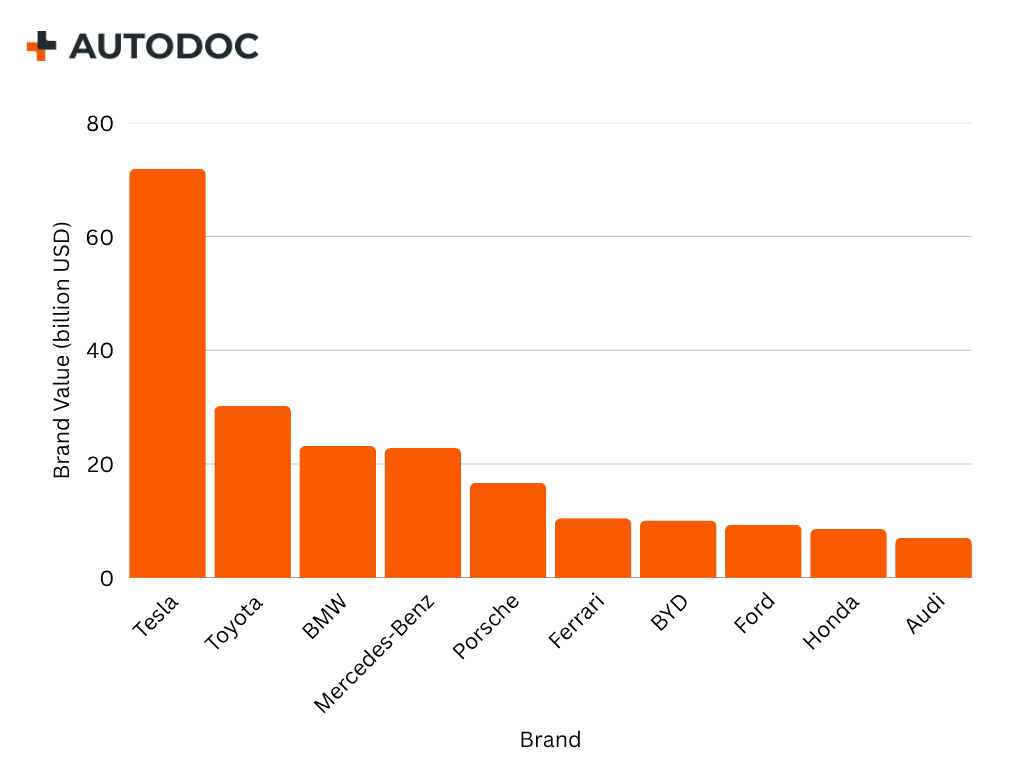

(Source: https://www.statista.com/statistics/267830/brand-values-of-the-top-10-most-valuable-car-brands/ )

Mercedes-Benz held a brand value of 22.8 billion U.S. dollars as of June 2024. This placed it fourth globally among automotive brands, behind Tesla, Toyota, and BMW. Mercedes ranked ahead of competitors such as Porsche, Ferrari, and Ford.

This position underscores Mercedes-Benz’s enduring global appeal as a luxury marque, supported by a legacy of engineering, safety, and design leadership. However, the narrowing gap with BMW — which slightly overtook it in brand value — signals an increasingly competitive premium segment.

Market Share: Tenth Globally in Volume Term

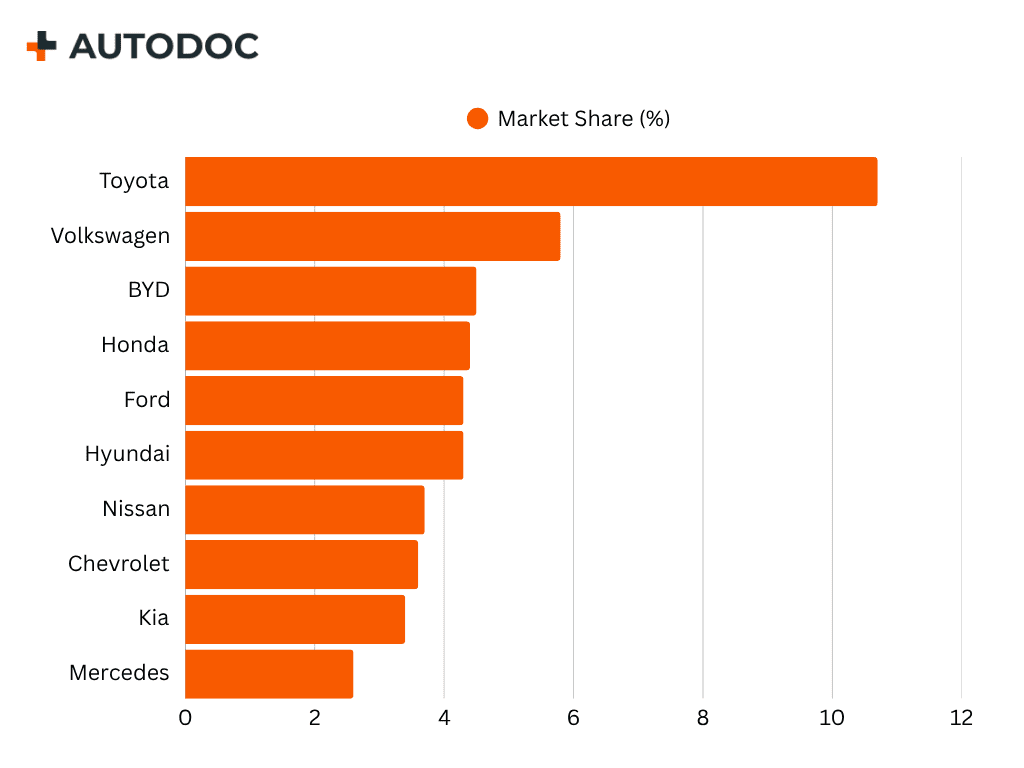

(Source: https://www.statista.com/statistics/316786/global-market-share-of-the-leading-automakers/ )

In terms of global market penetration by unit sales, the Mercedes brand accounted for 2.6% of the worldwide passenger car market in 2024. This ranked it tenth overall.

The comparatively lower market share reflects Mercedes-Benz’s deliberate focus on the premium segment rather than high-volume production. This is consistent with its product strategy and brand positioning.

Premium Positioning with Strategic Implications

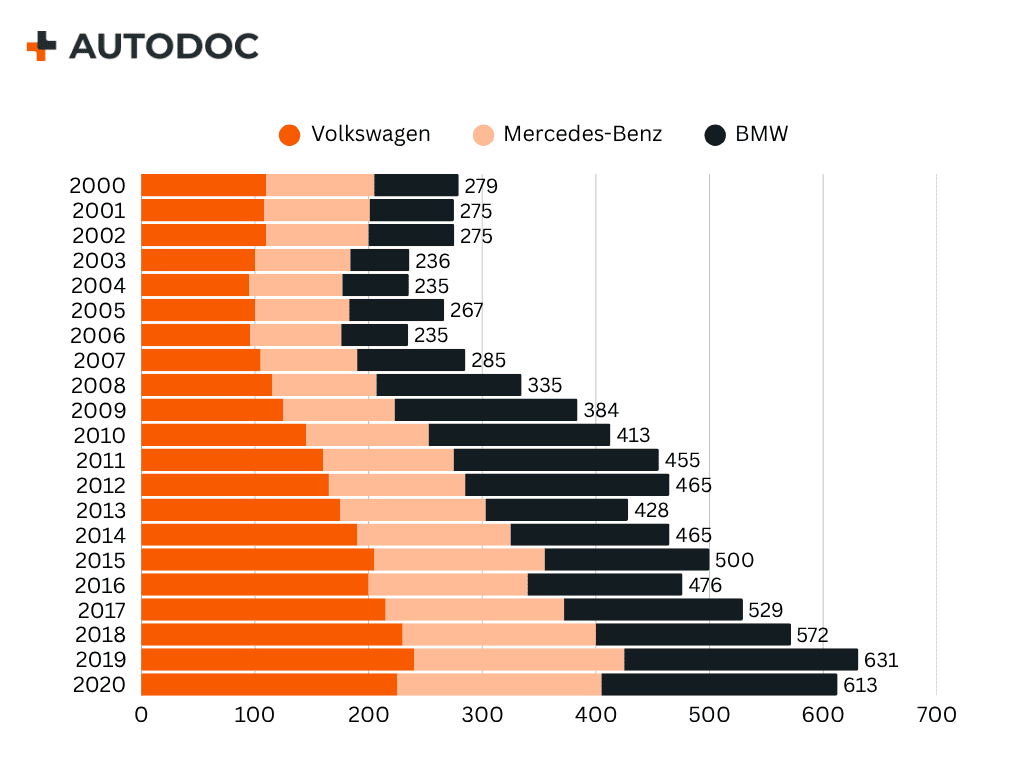

(Source: https://de.statista.com/statistik/daten/studie/234402/umfrage/umsatz-deutscher-automobilhersteller/ )

Despite a 5% year-on-year revenue decline in 2024, Mercedes-Benz overtook BMW in total revenue, recording 145.6 billion euros. BMW posted 142.4 billion euros (−8.4% YoY), while Volkswagen reached 324.7 billion euros (+0.7% YoY).

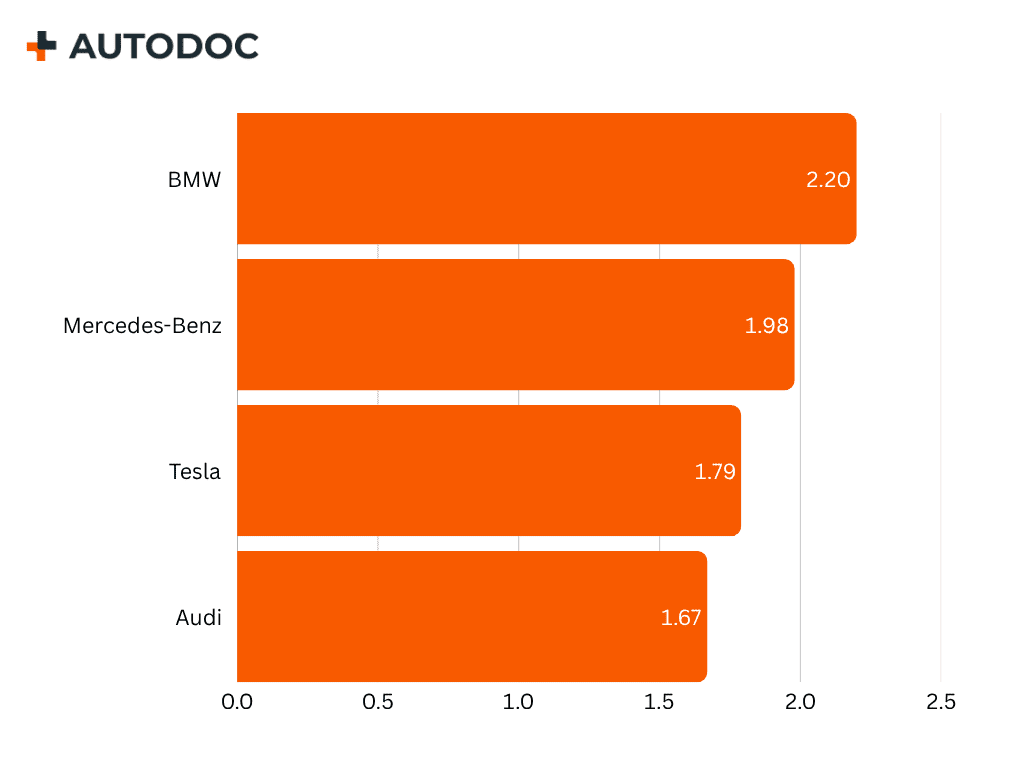

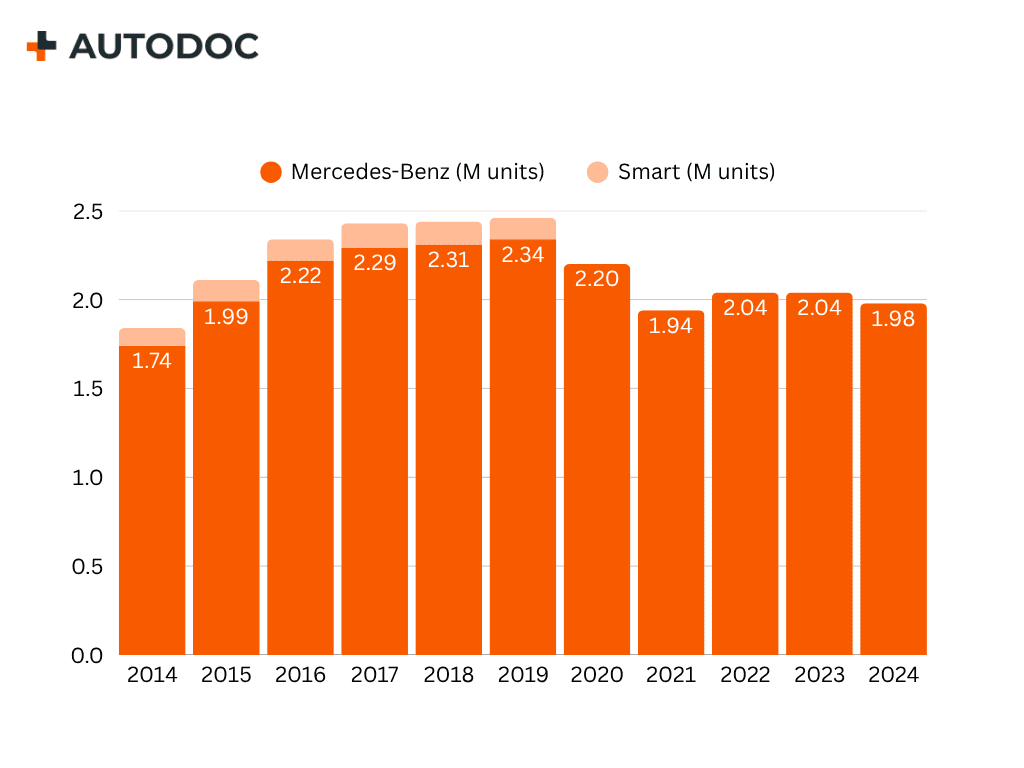

(Source: https://www.statista.com/statistics/262921/global-production-of-luxury-cars-by-make/ )

Mercedes-Benz sold approximately 1.98 million vehicles globally in 2024 among luxury brands, placing it second behind BMW, which sold 2.2 million units. Tesla and Audi followed with 1.79 million and 1.67 million units respectively.

The discrepancy between revenue and volume underscores the different operating models: Volkswagen’s scale across multiple market tiers versus Mercedes-Benz’s high-margin premium focus. Although BMW surpassed Mercedes-Benz in unit sales, Mercedes-Benz generated more revenue overall, suggesting higher revenue per vehicle and a continued emphasis on price positioning and model mix. Going forward, the brand's challenge will be sustaining this profitability lead while adapting its premium identity to meet the demands of electrification and software-led innovation.

Production & Global Deliveries

Worldwide Vehicle Production

In 2024, the Mercedes-Benz Group produced a total of 2.37 million vehicles, down from 2.51 million the previous year. This corresponds to a year-on-year decline of approximately −5.6%. The decrease affected both passenger cars and light commercial vehicles. Passenger car production fell to 1.97 million units, while van production accounted for 396,000 units, both marking reductions compared to 2023.

This downturn in production volume occurred against the backdrop of normalising post-pandemic supply chains and a market-wide recalibration in the face of increased electric vehicle competition and cost-sensitive consumer behaviour.

Global Car Deliveries

(Source: https://de.statista.com/statistik/daten/studie/72972/umfrage/verkaufte-pkw-von-mercedes-benz-cars/ )

In terms of sales, the Group reported a global delivery volume of 2,389,013 vehicles across its passenger car and van businesses in 2024, compared to 2,491,841 units in 2023. This represents a decline of −4.1% year-on-year. Deliveries of Mercedes-Benz Cars totalled 1,983,403 units, consistent with production trends, and showing moderate contraction across most regions.

Sales performance varied by market. In Europe, deliveries declined to 641,792 units (−2.7%). The United States saw a rise in deliveries to 324,529 units (+8.9%), while deliveries in China dropped to 683,568 units (−7.3%).

Sales by Segment

Mercedes-Benz Vans sold 405,610 units in 2024, reflecting a decline of 9.4% compared to 2023. Of these, 343,683 units were commercial vans, comprising:

- Large vans (Sprinter/eSprinter): 219,127 units (−7.7%)

- Mid-size vans (Vito/eVito): 101,205 units (−14.9%)

- Small vans (Citan/eCitan): 23,351 units (−3.2%)

The remaining 61,926 units were private vans, including:

- Mid-size private vans (V-Class, EQV): 56,809 units (−5.3%)

- Small private vans (T-Class, EQT): 5,117 units (−30.6%)

Electrified van sales (xEVs) totalled 19,516 units (−13.9%). Their share of total van unit sales declined from 5.1% to 4.8%.

Financial Overview

Group Revenue and Operating Profit

The Mercedes-Benz Group reported revenue of €145.6 billion in 2024, representing a decline of 5.0% compared to €153.2 billion in 2023. Earnings before interest and taxes (EBIT) amounted to €13.6 billion in 2024, which is significantly lower than the €19.7 billion posted in the previous year. This steep drop in operating profit reflects a mix of lower sales volumes, pricing pressure in the electric vehicle segment, and elevated costs in logistics and transformation-related areas.

Segment Financials: Mercedes-Benz Cars and Vans

(Source: https://de.statista.com/statistik/daten/studie/30737/umfrage/umsatz-der-daimler-ag/ )

Mercedes-Benz Cars generated €107.8 billion in revenue in 2024, down from €112.8 billion in 2023. This reduction is consistent with the contraction in global passenger car deliveries and softening demand in key international markets, particularly in China and Europe.

Mercedes-Benz Vans posted revenue of €19.3 billion, slightly below the €20.3 billion achieved in 2023. The decline reflects reduced sales volumes, notably in the fleet and commercial channels across European markets.

Research and Development (R&D)

(Source: https://de.statista.com/statistik/daten/studie/219724/umfrage/funde-ausgaben-der-daimler-ag/ )

The Group invested €9.72 billion in research and development in 2024, compared to €10.0 billion in the previous year. These funds were directed primarily towards the continued advancement of electric platforms, next-generation vehicle software, and automated driving systems. The year-on-year decline reflects marginal project streamlining and capital allocation discipline.

Regional Performance

Europe

Europe remained a major market for the Mercedes-Benz Group in 2024, though unit sales declined compared to the previous year. Deliveries fell to 641,792 units, down from 659,627 units in 2023 — a decline of 2.7% year-on-year. Germany continued to be the largest individual European market.

North America

In North America, total unit sales reached 365,358 units in 2024, up from 339,493 units the previous year. This reflects a growth of 7.6%. Within that total, the United States accounted for 324,529 units, an 8.9% increase year-on-year.

Asia

Asia recorded deliveries of 892,147 units in 2024, compared to 963,789 units in 2023, representing a decline of 7.4%. Within this total, China accounted for 683,568 units, down from 737,226 units the previous year — a decline of 7.3%.

Other Markets

Sales in Latin America, the Middle East, Africa, and Oceania increased to 84,106 units in 2024, up from 81,142 units in 2023. This represents a year-on-year increase of 3.7%, contributing modestly to the Group’s global performance.

Electrification & Sustainability

BEV Deliveries and Market Share

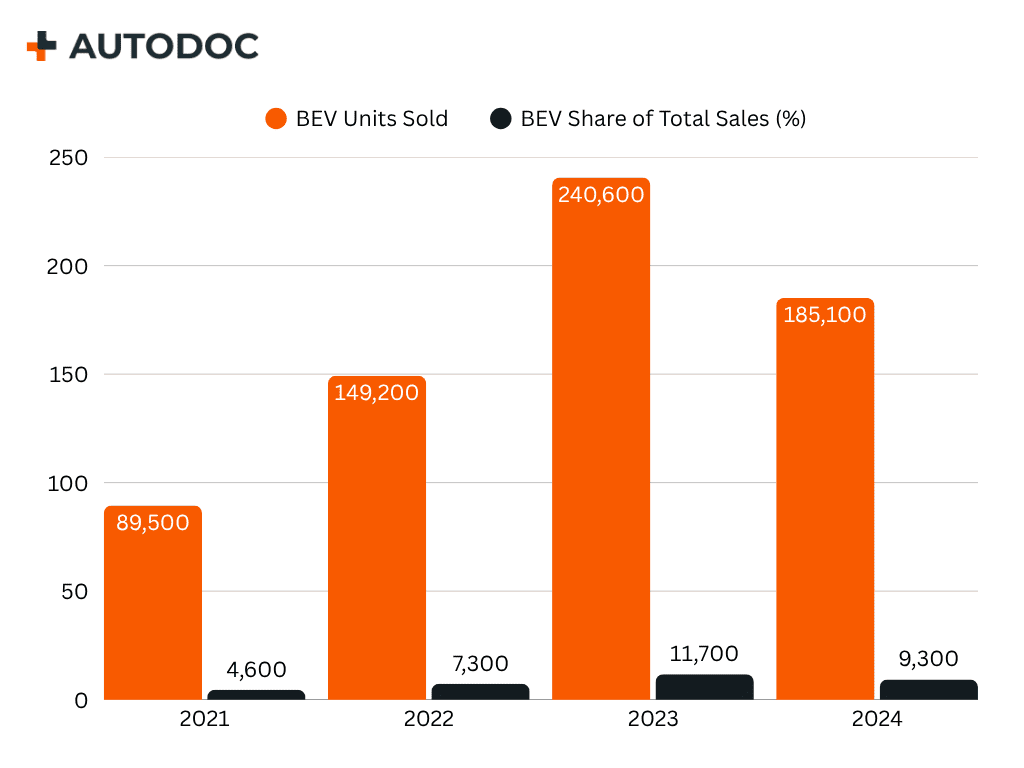

(Source: https://de.statista.com/statistik/daten/studie/1460745/umfrage/absatz-e-autos-mercedes-benz/ )

In 2024, Mercedes-Benz Cars sold 185,059 battery electric vehicles (BEVs) globally, down from 240,668 in 2023. This marks a −23.1% year-on-year decline. The share of BEVs in total Mercedes-Benz Cars sales fell from 11.8% in 2023 to 9.3% in 2024.

This decline occurred amid increased pricing pressure, competitive EV offerings from new market entrants, and evolving consumer confidence in charging infrastructure availability.

PHEV Trends

Conversely, plug-in hybrid electric vehicles (PHEVs) saw growth. Mercedes-Benz Cars delivered 161,275 PHEVs in 2024, a +13% increase from 182,551 in 2023. This growth partly offset the BEV decline and suggests sustained demand for hybrid options during the transition to fully electric mobility.

xEV Penetration

In total, 367,610 electrified vehicles (xEVs)—including BEVs and PHEVs—were sold by Mercedes-Benz Cars in 2024, representing 18.5% of total unit sales. This is a slight decrease from 2023, when xEVs comprised 19.7% of the mix (401,943 units) .

Among vans, the Group sold 19,516 electrified vans in 2024, all of which were fully electric (BEV) models. This figure declined from 22,666 in 2023, a −13.9% drop—with the xEV share in van sales falling to 4.8%, down from 5.1% the previous year.

Charging Infrastructure and Sustainability Commitments

Mercedes-Benz drivers can access more than 2 million public AC and DC charging points worldwide through the Mercedes me Charge service, which aggregates over 1,600 providers. In parallel, the Group is establishing its own Mercedes-Benz Charging Network, aimed at deploying around 10,000 fast-charging points globally by 2030 across Europe, North America, China, and other core regions.

To reinforce its climate goals, the company supports “Green Charging” across Europe, Canada, and the U.S. Where renewable energy isn’t directly available, green electricity certificates ensure that an equivalent volume of clean energy is fed into the grid. These certificates originate from power plants commissioned within the past six years.

Strategic Outlook for Electrification

Electrification remains central to Mercedes-Benz’s “Ambition 2039”, which aims for a net carbon-neutral new vehicle fleet by 2039, spanning the entire value chain and vehicle lifecycle. The Group plans to retain drivetrain flexibility into the 2030s, offering electric, hybrid, and high-tech combustion models in parallel.

Mercedes-Benz Vans will transition to its new Van Electric Architecture (VAN.EA) starting in 2026, with internal combustion counterparts based on the Van Combustion Architecture (VAN.CA). These vehicles will incorporate MB.OS, a next-generation operating system that enables SAE Level 3 (conditional) and Level 4 (highly automated) driving features.

Human Capital

Workforce Size and Composition

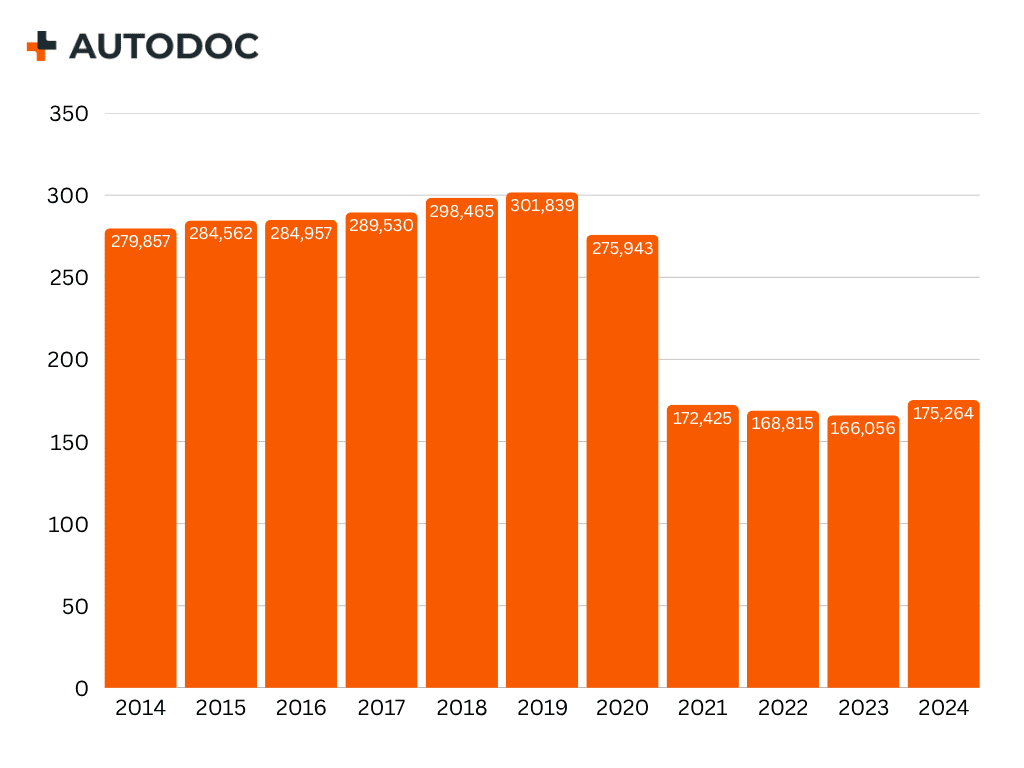

(Source: https://de.statista.com/statistik/daten/studie/218556/umfrage/beschaeftigte-der-daimler-ag/ )

As of 31 December 2024, the Mercedes-Benz Group employed 175,264 people worldwide across all business units and regions. This represents an increase of 9,208 employees, or approximately 5.5%, compared to the 166,056 employed at the end of 2023. The growth in headcount reflects the Group’s continued investment in high-value competencies, particularly in digitalisation, electrification, and software.

Diversity and Representation

Mercedes-Benz has made measurable progress in leadership diversity. Women held 37.5% of the eight seats on the Board of Management by year-end 2024, exceeding the Group’s long-standing 25% target. On the Supervisory Board, gender parity was close to being achieved, with 40% representation on both the shareholder and employee sides.

At the first executive level below the Board of Management, women made up 45.5% of all executives. At the second level, the share was 31.3%. These figures outperformed the company’s previously set diversity targets of 20% and 25% for these levels, respectively. When expanded to management levels 1–3 globally, women held 26.4% of roles, while men held 73.6%.

Age and Internationality

Generational and geographic diversity also characterise the Group’s leadership. By the end of 2024, all Board of Management members either came from international backgrounds or had international experience. Additionally, 50% of them were aged 57 or younger when their current terms began. Across the wider workforce, the age distribution was 13.1% under 30 years old, 56.8% between 30 and 50, and 30.1% over 50.

Workforce Transformation and Training

Mercedes-Benz has significantly invested in retraining and reskilling in response to structural shifts such as electrification and AI. The company’s workforce development is built on initiatives like “Turn2Learn,” which enables employees to prepare for both current and future job profiles through flexible and self-directed learning.

The Group offers comprehensive programs including training in generative AI, digitalisation, and electromobility. For example, tens of thousands of employees participated in learning journeys focused on artificial intelligence in 2024. Initiatives like “D.SHIFT” and structured learning paths for roles such as Data Analyst, Data Engineer, and Data Scientist are also part of the transformation effort. These programmes offer certifications recognised in the broader job market.

Competitive Positioning

Global Market Standing

Mercedes-Benz maintained its status as one of the world’s leading premium automotive brands in 2024. It ranked second globally in luxury car sales, delivering approximately 1.98 million vehicles, slightly behind BMW’s 2.2 million. Tesla and Audi followed with 1.79 million and 1.67 million units, respectively. Despite trailing BMW in volume, Mercedes-Benz outperformed it in revenue, generating €145.6 billion versus BMW’s €142.4 billion, reinforcing its high-value positioning.

In terms of overall global automotive market share by volume, Mercedes-Benz held a 2.6% share, ranking it tenth worldwide. This relatively modest position reflects the Group’s focused strategy on the high-margin luxury segment rather than competing in broader volume markets.

EU Market Performance

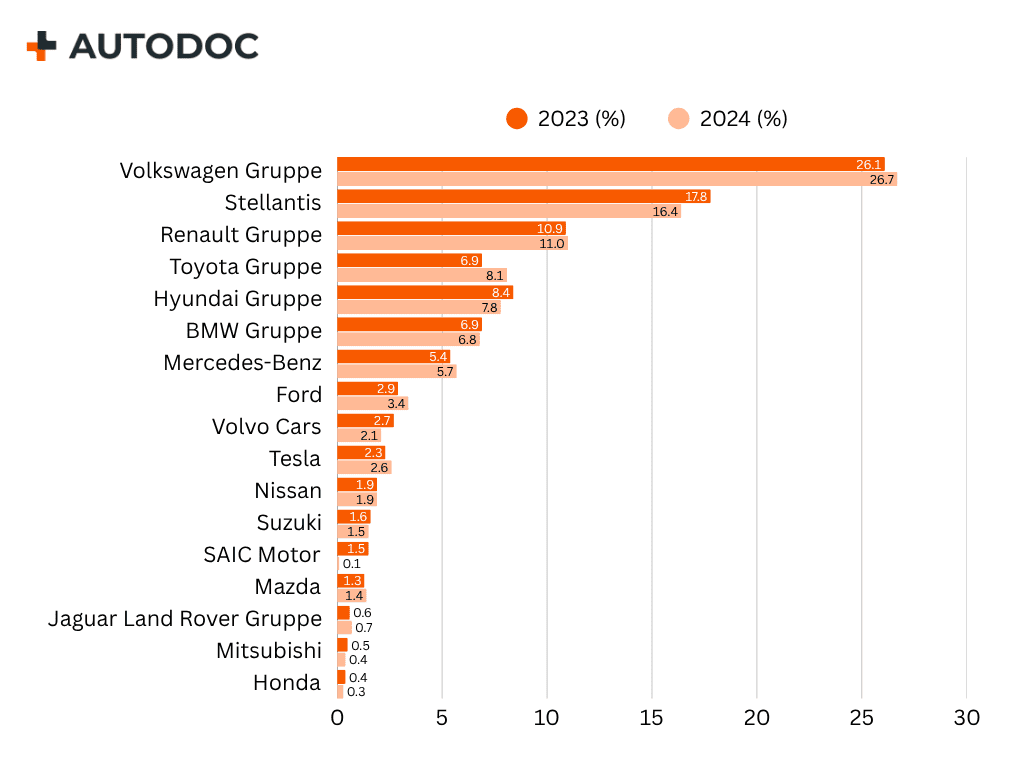

(Source: https://de.statista.com/statistik/daten/studie/12782/umfrage/marktanteile-ausgewaehlter-autohersteller-in-europa/ )

Within the European Union, Mercedes-Benz captured a 5.4% share of new car registrations in 2024, placing it behind brands such as Volkswagen (26.7%), Stellantis (16.4%), and BMW (6.8%). While its volume was smaller, Mercedes-Benz’s performance was aligned with its selective premium strategy.

Profitability and Operational Leverage

Mercedes-Benz delivered strong profitability in 2024, driven by disciplined pricing and strategic product mix. It reported an adjusted EBIT margin of 8.1% in its Mercedes-Benz Cars division and a 14.6% margin in Vans. These margins reflect the Group’s focus on operational efficiency and high-value segments.

Strategic Differentiators

Mercedes-Benz's competitive edge lies in its consistent delivery of innovation-led luxury. The launch of its proprietary MB.OS operating system, debuting with the next-generation CLA, strengthens the brand’s technological proposition through enhanced connectivity, data sovereignty, and digital experiences.

Moreover, the company’s dual-architecture approach—offering both high-tech combustion and all-electric drivetrains into the 2030s—provides it with agility across market scenarios. This flexibility, combined with investment in modular architectures like MMA and MB.EA, supports both scalability and product differentiation.

Finally, Mercedes-Benz’s iconic brand identity—associated with performance, safety, and prestige—continues to command global recognition, reinforcing customer loyalty even amid shifting market dynamics.

Conclusion & Strategic Outlook

Mercedes-Benz Group concluded 2024 facing intensifying global headwinds, from macroeconomic uncertainty to structural industry shifts in electrification and software. Despite a decline in sales and profitability, the Group maintained its high-margin positioning and advanced key elements of its long-term transformation strategy. These included deepened commitments to sustainability, ongoing investment in product architecture innovation, and adaptive flexibility in drive systems. The leadership reiterated its dual ambition: to preserve the legacy of luxury while executing a sustainable and tech-forward evolution.

Looking into 2025, Mercedes-Benz anticipates continued macroeconomic pressure. Group revenue and EBIT are expected to decline, while capital expenditures and R&D investments will remain elevated to support the rollout of next-generation electric and digital platforms. Sales volumes for both Cars and Vans are projected to dip slightly year-over-year. However, the share of electrified vehicles is forecast to grow modestly, reaching 20–22% for Cars and 8–10% for Vans.

Under its “Ambition 2039” strategy, the Group is targeting net carbon neutrality across the entire new vehicle fleet by 2039. As part of this transition, Mercedes-Benz plans to:

- Reduce Scope 1 and 2 production emissions by 80% by 2030 (vs. 2018)

- Achieve 100% renewable electricity usage in production by 2039, with interim milestones of 70% (Cars) and 80% (Vans) by 2030

- Cut specific energy consumption per vehicle by 36% for Cars and 16% for Vans by 2030 (vs. 2023)

- Reach a 50% electrified vehicle share in new sales during the second half of the decade

The path forward will be shaped by infrastructure maturity, customer behaviour, and geopolitical conditions. Nonetheless, Mercedes-Benz enters 2025 with a clear blueprint: scaling innovation, deepening sustainability, and reinforcing its leadership in the luxury mobility space.

Sources:

- Mercedes-Benz Group Dossier from Statista.com

- https://de.statista.com/statistik/studie/id/7431/dokument/daimler-ag-statista-dossier/

- Mercedes-Benz Group Annual Report 2024

- https://group.mercedes-benz.com/documents/investors/reports/annual-report/mercedes-benz/mercedes-benz-annual-report-2024-incl-combined-management-report-mbg-ag.pdf